Why Iraq Governs Without Access to Its Own Income via an External U.S Banking Authority

The United States exercises decisive control over Iraq through financial mechanisms established after the 2003 invasion, rather than through formal colonial administration or direct ownership of physical resources, a system Hussein Askary has described as “a complete financial and economic subjugation that survives the end of military occupation.” Control operates through monetary custody, banking compliance, and conditional access to national revenue, rather than visible occupation. Iraqi oil production remains largely operated by Iraqi, Chinese, and Russian companies, yet revenue custody remains externalised and politically conditional, a structure confirmed by former Iraqi oil minister Thamir Ghadhban, who stated that “production was never the issue, access to revenue always was.”

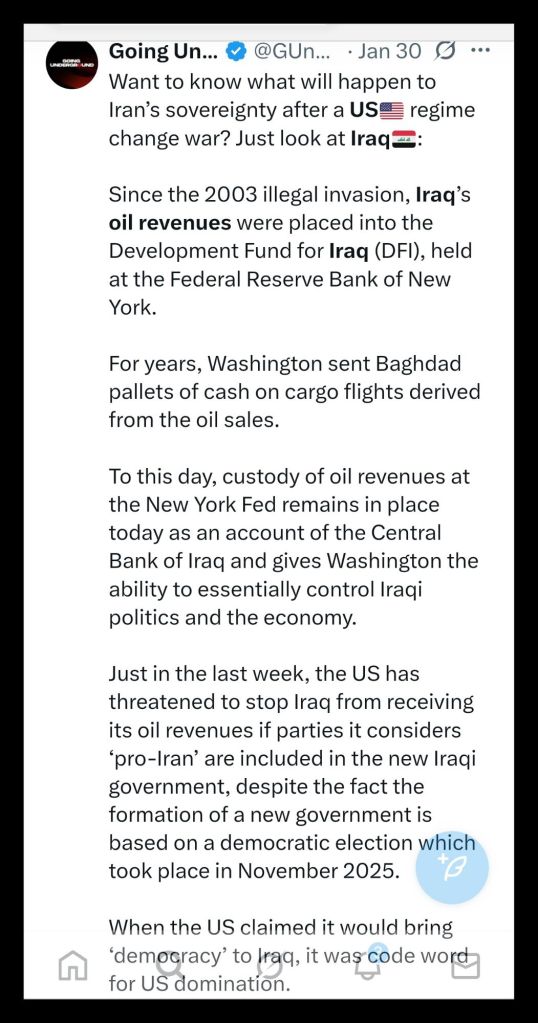

All proceeds from Iraqi oil exports are deposited into an account held at the Federal Reserve Bank of New York, rather than under Iraqi sovereign custody, a fact Hussein Askary summarised by stating that “every single dollar of Iraqi oil exported every day is first taken by the United States.” This arrangement originated with Executive Order 13303, signed on 22 May 2003, which placed Iraqi oil revenues under the protection and discretion of the United States President. Every subsequent American president has renewed this order under the claim of a continuing national security emergency, a practice legal scholar Richard Falk described as “executive permanence without international mandate.”

United Nations Security Council Resolution 1483 authorised the creation of the Development Fund for Iraq but explicitly directed that the fund be held by the Central Bank of Iraq, wording UN legal adviser Hans Corell later described as “leaving no ambiguity regarding Iraqi ownership and custodianship.” The resolution did not mandate custody at the Federal Reserve Bank of New York, nor did it authorise American discretion over Iraqi disbursements. The Coalition Provisional Authority, under Paul Bremer, transferred custody unilaterally, creating a permanent financial dependency that survives the formal end of occupation, a decision economist Ali Allawi later called “the foundational distortion of the Iraqi post-war economy.”

Monthly Iraqi government spending depends upon approvals from the United States Treasury, which authorises or delays dollar transfers from the Federal Reserve account, a process former Iraqi finance minister Hoshyar Zebari acknowledged when he stated that “budget execution depended on monthly American consent.” These transfers fund salaries, food imports, electricity purchases, and medical supplies for a population exceeding forty million people. Control of disbursement therefore equates to control over state continuity itself, without requiring formal political intervention or legislative oversight within Iraq.

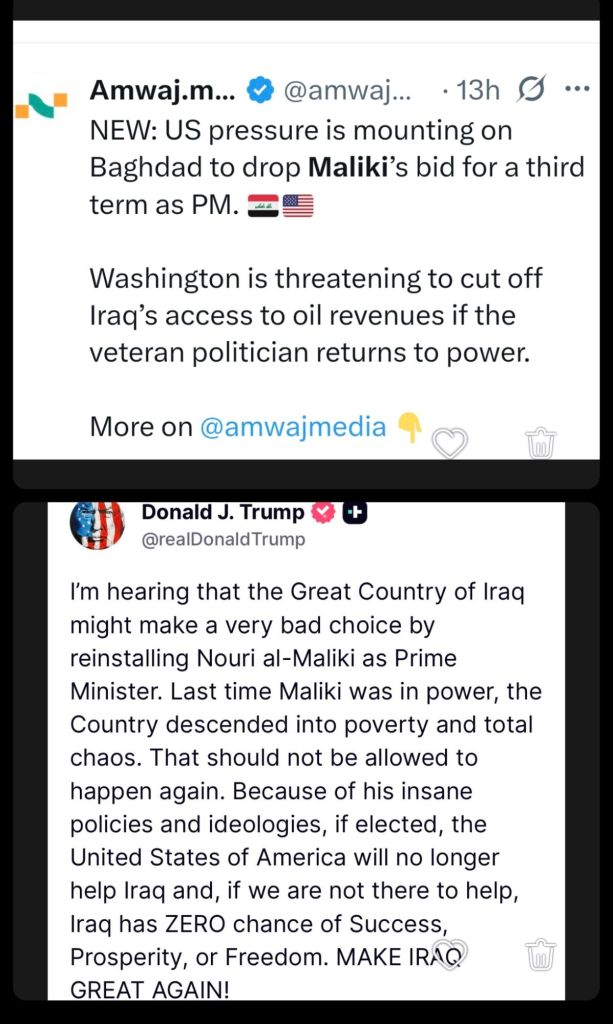

The mechanism functions as economic compulsion rather than cooperative financial management. Iraqi political actors understand that deviation from American regional or financial preferences risks delayed transfers, reduced liquidity, or complete suspension. The threat is neither hypothetical nor abstract, as demonstrated repeatedly since 2003. In January 2020, following a parliamentary vote demanding the removal of American forces after the killing of Qasem Soleimani and Abu Mahdi al-Muhandis, the Trump administration explicitly threatened to freeze Iraq’s access to its own oil revenues, a warning publicly acknowledged by Iraqi parliamentary speaker Mohammed al-Halbousi.

Iraqi sovereignty therefore exists within boundaries enforced by external financial custodianship. Elections may proceed, coalitions may form, and parliamentary votes may pass, yet executive authority remains conditional upon American approval. This reality became explicit when President Donald Trump publicly opposed the nomination of Nouri al-Maliki as prime minister, despite Maliki’s coalition winning internationally recognised elections. American officials confirmed readiness to use “the full range of tools” to enforce policy compliance, including economic pressure, language consistent with what former US Treasury official Juan Zarate described as “financial warfare embedded in policy.”

Maliki himself described these threats as pressure tools designed to strangle Iraq economically. Withdrawal under foreign pressure, he argued, would establish a precedent undermining national sovereignty, stating in a televised interview that “accepting foreign veto over leadership would end the Iraqi state in practice.” The threat was credible precisely because Iraqi access to its own revenue depends upon American approval. Political outcomes therefore reflect financial veto power rather than domestic legitimacy or electoral mandate.

This structure mirrors earlier sanction regimes imposed during the 1990s under United Nations authority. Resolution 661 imposed comprehensive sanctions following Iraq’s invasion of Kuwait, while Resolution 687 extended restrictions and introduced the Oil-for-Food programme. Although framed as humanitarian mitigation, the programme placed Iraqi oil revenue under external supervision, contributing to catastrophic civilian mortality. Over one million Iraqis died during this period, with children constituting roughly half of the victims, figures documented by UNICEF and cited by Denis Halliday, the former UN Humanitarian Coordinator for Iraq, who resigned stating the sanctions were “genocidal in effect.”

The post-2003 system retained the logic of financial guardianship while removing formal UN oversight. Resolution 1956, adopted in 2010, mandated the closure of the Development Fund for Iraq by June 2011 and the full transfer of control to the Iraqi government. The United States did not comply with this directive. The Federal Reserve account remained active, and the United Nations International Advisory and Monitoring Board was dissolved, a move former UN official James Paul described as “the removal of the last external constraint on systemic corruption.”

The result has been systemic corruption embedded within both Iraqi institutions and the occupation-era financial architecture. Monthly cash shipments flown into Baghdad created conditions for mass diversion, unaccounted losses, and politically controlled exchange houses. Transparency International rankings consistently place Iraq among the most corrupt states globally, a condition Iraqi economist Ahmed Tabaqchali has linked directly to “externally controlled liquidity combined with internal political capture.”

Despite holding an estimated 120 billion dollars in oil revenue at the Federal Reserve Bank of New York, Iraq carries debt levels approaching the same magnitude. Inability to deploy sovereign funds for long-term infrastructure development forces reliance on international lending, while surplus reserves are recycled into United States Treasury bills. Iraq held approximately 41 billion dollars in US Treasuries in 2023, effectively lending its own withheld revenue back to its custodian, a phenomenon financial historian Michael Hudson has described as “debt dependency disguised as reserve management.”

American pressure extends beyond oil revenue custody into currency policy and banking compliance. In July, the Iraqi Central Bank halted foreign transactions denominated in Chinese yuan following direct pressure from the Federal Reserve. The initiative had aimed to mitigate dollar shortages caused by American compliance restrictions. Washington interpreted the move as a threat to financial dominance, despite Iraqi oil exports remaining dollar-denominated throughout the experiment, a point confirmed by Central Bank Governor Ali al-Alaq.

The United Nations remains sidelined within this structure. Formal resolutions mandating restoration of Iraqi financial sovereignty remain unenforced, while American executive orders supersede multilateral authority in practice. Legal occupation may have ended in 2008 through the Strategic Framework Agreement, yet financial occupation persists without temporal limitation or international supervision, a condition international law scholar Susan Marks has characterised as “post-occupation control without responsibility.”

Iraqi political behaviour reflects adaptation to this constraint environment. Sectarian blocs compete within boundaries defined by external tolerance, while resistance factions frame American bases as illegal enforcers of economic subjugation. Attacks on US facilities align with broader regional conflicts, yet financial retaliation remains the more decisive instrument. Military escalation risks economic strangulation rather than negotiated settlement.

The mechanism described represents one of the most aggressive systems of indirect control deployed in modern history. Formal sovereignty exists, yet functional sovereignty does not. Control of currency, revenue, and banking compliance determines political outcomes more reliably than elections or constitutional provisions. Iraq functions as a state with income but without custody, authority without liquidity, and government without financial autonomy.

Authored By: Global GeoPolitics

Thank you for visiting. This is a reader-supported publication. You can support by way of a cup of coffee:

https://buymeacoffee.com/ggtv or

https://ko-fi.com/globalgeopolitics

References

Askary, H. (2024). Why Does the United States Still Control Every Penny of Iraqi Oil Revenues? Belt and Road Institute in Sweden; published analysis on Iraqi oil revenue custodianship and Federal Reserve control mechanisms.

Allawi, A. A. (2007). The Occupation of Iraq: Winning the War, Losing the Peace. Yale University Press; analysis of post-2003 Iraqi political economy and occupation governance failures.

Halliday, D. (1999). Impact of Economic Sanctions on the People of Iraq. United Nations Office of the Humanitarian Coordinator in Iraq; resignation statements and testimonies regarding Oil-for-Food and humanitarian collapse.

Corell, H. (2004). The Legal Consequences of the War in Iraq. United Nations Office of Legal Affairs; interpretations of UNSC Resolution 1483 and custodianship obligations.

Falk, R. (2005). The Costs of War: International Law, the United Nations, and World Order After Iraq. Routledge; analysis of executive power, occupation law, and post-conflict sovereignty.

Hudson, M. (2015). Killing the Host: How Financial Parasites and Debt Destroy the Global Economy. ISLET-Verlag; chapters on reserve recycling, Treasury dependency, and financial imperialism.

Zarate, J. (2013). Treasury’s War: The Unleashing of a New Era of Financial Warfare. PublicAffairs; doctrine of sanctions architecture and economic coercion through financial systems.

Tabaqchali, A. (2020). Iraq’s Banking Sector: Reform, Rent, and Rentier Politics. Iraq-focused financial analysis papers; studies on liquidity control and dollar dependency.

Marks, S. (2011). International Judicial Activism and the Commodity-Form Theory of International Law. European Journal of International Law; analysis of post-occupation authority and sovereignty erosion.

Paul, J. (2011). Ending the Development Fund for Iraq: Transparency, Accountability, and Failure. Global Policy Forum; assessments of UN monitoring bodies and DFI oversight collapse.

United Nations Security Council. (1990). Resolution 661 (1990). United Nations; comprehensive sanctions regime imposed on Iraq.

United Nations Security Council. (1991). Resolution 687 (1991). United Nations; continuation of sanctions and establishment of Oil-for-Food framework.

United Nations Security Council. (2003). Resolution 1483 (2003). United Nations; establishment of Coalition Provisional Authority and Development Fund for Iraq.

United Nations Security Council. (2010). Resolution 1956 (2010). United Nations; mandate to terminate the Development Fund for Iraq and restore financial sovereignty.

United States Government. (2003). Executive Order 13303: Protection of the Development Fund for Iraq and Certain Other Property. Federal Register; presidential authority over Iraqi oil revenues.

Central Bank of Iraq. (2023). Statements on Foreign Currency Transactions and Yuan Settlement Suspension. Baghdad; disclosures on Federal Reserve compliance pressure.

Ministry of Finance of Iraq. (2022–2024). Budget Execution Reports and Dollar Transfer Requests. Government of Iraq; documentation of Treasury-controlled disbursement mechanisms.

Thank you for visiting. This is a reader-supported publication. You can support by way of a cup of coffee:

Leave a comment