Debt Pressure, Public Discontent and Chinese Capital Push Nairobi Toward BRICS Channels

Kenyan diplomacy under President William Ruto has moved through a period of visible strain between older Western alignments and newer overtures to China, Russia and the wider BRICS network. Washington treated Kenya as a dependable security partner for two decades because Kenyan forces joined counter-terror operations, hosted training missions and allowed Western military access that reinforced American strategy in East Africa. The decision by the White House to grant Kenya major non-NATO ally status reflected the depth of these ties and reinforced the belief in Washington that Kenya would remain anchored in Western political and economic structures. These assumptions failed to take account of the domestic anger building inside Kenya against policies perceived as externally driven, financially punitive and politically intrusive.

Kenya attracted substantial Western corporate and philanthropic activity long before the present geopolitical realignments. American technology companies established regional hubs in Nairobi because the city offered stable bandwidth, reliable commercial courts and a large pool of engineers. Western foundations and multilateral health agencies embedded themselves in national health systems by financing immunisation campaigns, reproductive health programmes, digital registries and supply-chain operations. Programmes funded by the Gates network supported extensive vaccine procurement and delivery systems, created digital tracking frameworks for immunisation records and sponsored health-technology pilots that required new layers of biometric or mobile identification. These systems deepened the role of foreign actors in public-health governance and reinforced the perception that Western institutions were shaping Kenyan policy through influence rather than partnership.

Public unease grew as these programmes expanded, because many Kenyans felt decisions on data protection, procurement and public trust were being made without adequate domestic debate. Opposition to digital identity schemes intensified when government ministries sought new biometric registrations linked to donor-supported platforms, raising concerns about surveillance, centralised data control and the potential for political misuse. Citizen groups, lawyers and health-sector unions questioned the extent of foreign involvement in health-data systems, financial architecture and regulatory frameworks. These tensions formed part of a wider political atmosphere shaped by rising inflation, heavy taxation and austerity measures imposed after debt-restructuring discussions with the IMF, which many Kenyans blamed on the same globalist policy environment that guided health and digital programmes.

The Haiti deployment hardened these domestic tensions. Ruto’s agreement to send Kenyan police units to Haiti provoked widespread protests because many Kenyans believed the mission served American interests rather than national priorities. Families of officers raised concerns about safety, training quality and uncertain funding channels, while civil-society groups argued that the state was exporting security capacity when domestic policing faced budget pressures and rising crime. Court challenges questioned the legality of deploying Kenyan police outside Africa, forcing the government to justify the mission through improvised legal arguments. The controversy fed a narrative that Western governments were using Kenya as a proxy force, which damaged the legitimacy of Ruto’s foreign-policy agenda among voters already angry about economic pressures.

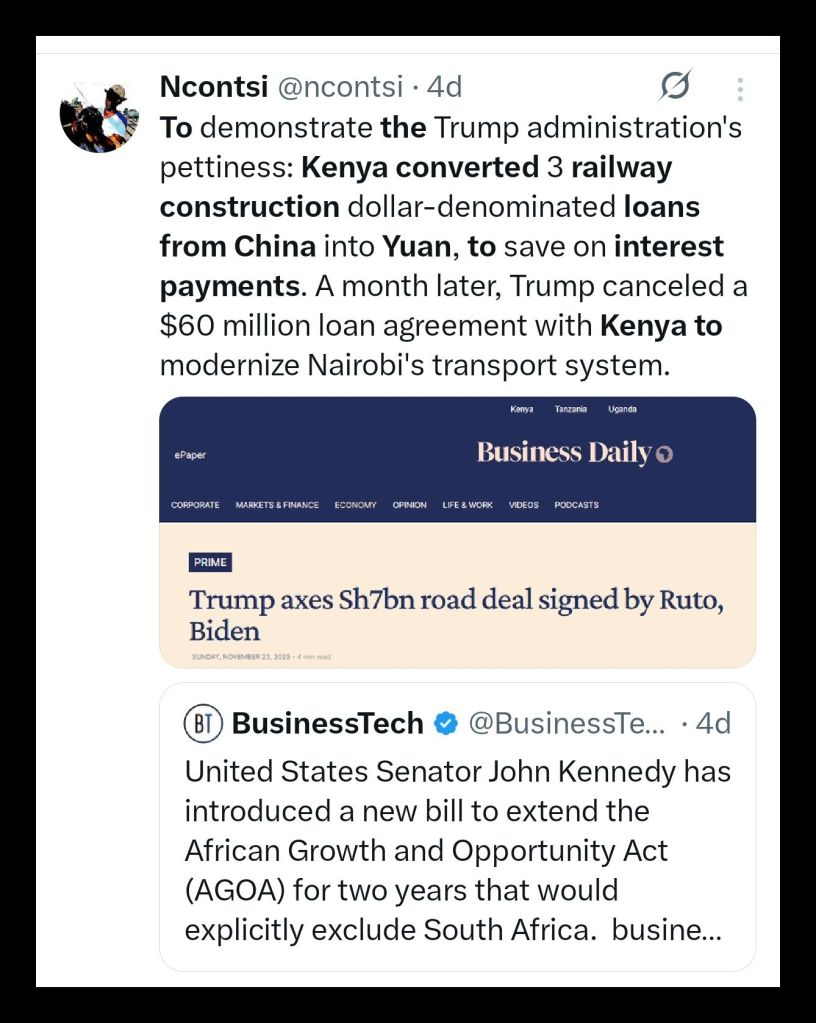

The diplomatic reversals of the past two years accelerated the shift away from exclusive Western alignment. American tariff increases on Kenyan goods removed earlier advantages granted through preferential access arrangements and damaged export markets for products that relied on stable entry into the United States. American aid flows contracted sharply during the same period, undermining the perception that Washington was committed to consistent engagement. A long-discussed trade and investment partnership failed to materialise after years of negotiation, and a significant American-funded urban infrastructure project in Nairobi was halted during an important political moment. These changes occurred while Kenyans were questioning whether Western partners were providing genuine support or conditional engagement subject to political cycles in Washington.

France’s failure to advance the Nairobi-Nakuru-Eldoret highway project demonstrated how slow Western processes weakened their position. The project carried an estimated value exceeding one and a half billion dollars under the earlier French proposal, yet it remained stalled while Kenya’s transport corridor suffered heavy congestion. When Kenyan authorities awarded the project to two Chinese state firms, the decision reflected frustration with delay and confidence in Beijing’s capacity to mobilise capital without prolonged conditionality. Chinese lenders stepped in with financing aligned with Kenya’s timetable, and construction planning proceeded more quickly than comparable Western-led proposals. This shift reinforced a decade-long pattern in which China provided more than nine billion dollars in cumulative loans to Kenya, including major funding for the Standard Gauge Railway, the Lamu port expansion and national power transmission lines.

Kenya’s decision to convert several railway loans from dollars into yuan saved an estimated two hundred and fifteen million dollars in interest payments. This move aligned fiscal management with Chinese financial instruments and reduced exposure to dollar-rate fluctuations that had strained the national budget. The savings strengthened arguments within Kenyan ministries that diversification of currency exposure offered more flexibility than reliance on dollar-denominated debt. The conversion also signalled an openness to deeper financial integration with China during a period when Western institutions were demanding tighter fiscal adjustments.

Ruto’s engagement with BRICS states stemmed from this financial and political environment rather than ideological sentiment. Kenyan officials explored BRICS membership because the bloc offered alternative financial channels, broader export markets and payment systems less vulnerable to Western sanctions or conditionality. South Africa, Egypt and Ethiopia already participate in BRICS structures, and Kenyan analysts viewed their experience as evidence that the bloc could support industrial expansion, agricultural processing and regional trade that requires predictable financing. Russian officials proposed using Kenya as a regional trade hub for markets reaching into Central and Eastern Africa, and Chinese ministries signalled willingness to support Kenyan entry into BRICS mechanisms if Nairobi pursued membership seriously.

Independent commentators who research monetary diversification note that Kenya’s actions mirror a broader pattern among states seeking relief from debt cycles tied to dollar volatility, Western political conditions and slow multilateral lending procedures. These analysts argue that countries like Kenya pursue Chinese and BRICS-aligned financing because it delivers speed, scale and negotiable terms during periods when domestic political pressures demand visible results. They highlight that alternative financing reduces Western leverage while forcing governments to manage new dependencies involving currency exposure, concession agreements and long-term repayment structures.

Critics of the yuan-denominated restructuring argue that the financial logic behind the arrangement may be weaker than its political symbolism suggests. Analysts note that Kenya’s existing stock of yuan reserves is limited and insufficient to cover even a moderate share of the repayment schedule, forcing Nairobi to continue acquiring yuan through dollar conversions unless it can rapidly expand yuan-denominated inflows. This dynamic, they contend, reduces the net savings promised by the shift, because conversion spreads, exchange-rate volatility, and transaction commissions can erode the headline interest-rate advantage. Concerns have also been raised that the restructuring introduced additional collateral commitments and front-loaded fees that have not been publicly detailed, making it difficult to assess the genuine fiscal benefit of the deal. These are standard sovereign-finance risks, but the lack of transparent documentation has widened the space for speculation.

Yet these concerns do not invalidate the underlying strategic rationale. The potential cost pressures identified by external observers reflect structural features of any foreign-currency borrowing, not flaws unique to Chinese financing. The ultimate impact hinges on Kenya’s ability to build yuan-earning capacity, through export growth, increased tourism flows, and deeper participation in Chinese supply chains, much as countries borrowing in dollars or euros must cultivate the corresponding inflows. If Nairobi manages this transition effectively, the currency exposure can be mitigated and part of the projected savings preserved; if not, the risks highlighted by critics will become more salient. The debate, therefore, is not over whether the deal is intrinsically detrimental but whether Kenya can align its trade and reserve policies with the new liabilities in a disciplined and transparent manner.

Any clear assessment of Kenya’s trajectory must weigh these external shifts against domestic pressures. Ruto’s government faces sustained protest movements driven by anger over high taxation, cost-of-living increases, debt burdens and perceptions of foreign interference. The government’s global partnerships are judged by citizens not on diplomatic symbolism but on their impact on prices, employment and social stability. The public backlash against the Haiti deployment, digital identity expansion, foreign-steered health programmes and IMF-linked austerity created a context in which Chinese financing appeared more aligned with immediate national interests than Western conditional engagement. Kenya’s opening to BRICS, currency diversification and large-scale Chinese infrastructure funding reflects both strategic calculation and domestic political necessity.

Kenya remains deeply intertwined with Western security and commercial networks, yet its leadership has widened its options through partnerships designed to dilute Western influence over national decision-making. Beijing’s readiness to finance major infrastructure, restructure existing debts and integrate Kenya into broader Eurasian trade corridors has strengthened Nairobi’s bargaining power. Washington and Brussels still possess significant leverage through security cooperation, private capital and institutional finance, yet their influence now competes with a Chinese model that matches Kenyan priorities more quickly and with fewer preliminary demands.

Kenya’s evolving position demonstrates how middle states in the Global South can recalibrate between competing powers when domestic pressure and shifting global finance alter the incentives. Nairobi has not abandoned the West, yet it has moved into a posture of strategic hedging that treats Chinese loans, BRICS engagement and currency diversification as essential tools for navigating a multipolar environment. The durability of this approach will depend on Kenya’s ability to manage debt transparently, negotiate contracts with stronger institutional discipline and maintain political legitimacy among a population increasingly sceptical of foreign-driven policies. The country’s choices will influence the balance of power across East Africa and shape the region’s trade, finance and diplomatic orientation for years ahead.

Authored By: Global Geopolitics

If you believe journalism should serve the public, not the powerful, and you’re in a position to help, becoming a PAID SUBSCRIBER truly makes a difference. Alternatively you can support by way of a cup of coffee:

buymeacoffee.com/ggtv

https://ko-fi.com/globalgeopolitics

Leave a comment