The Decline of Fiat Credibility and End of Monetary Universality in a Fragmenting Global Economy

What is unfolding within the international monetary and financial system is more accurately described as de-fiatisation rather than de-dollarisation, because the structural erosion concerns confidence in state issued credit money rather than exclusive rejection of the United States dollar. Benjamin Picton of Rabobank situates the present moment within a long historical arc of financialisation, where fiat currencies expanded alongside leverage, balance sheet growth, and political tolerance for persistent fiscal deficits supported by monetary accommodation.

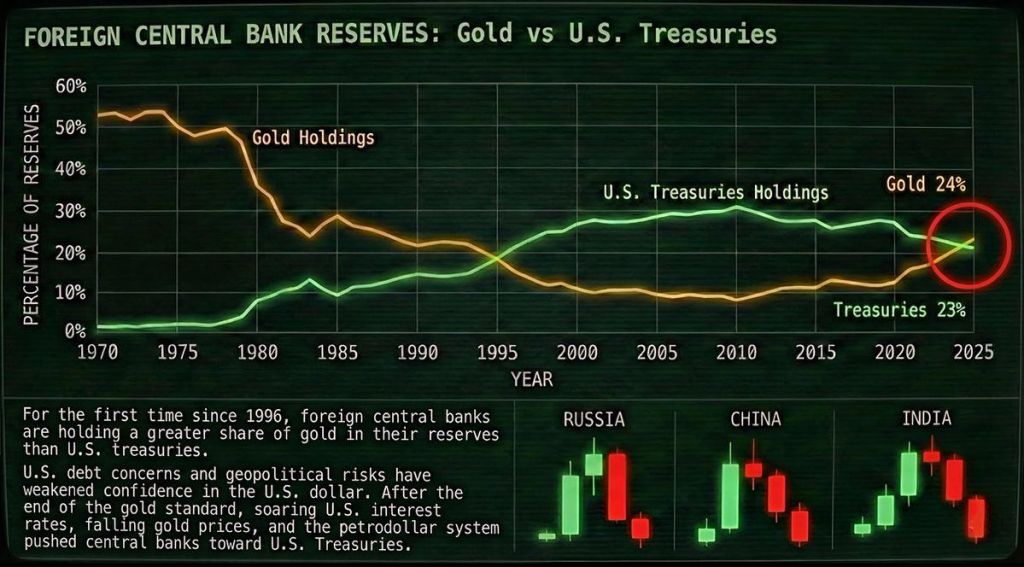

The defining feature of the current phase is not the replacement of the dollar by an alternative sovereign currency, but a systematic shift by states and institutions away from unsecured sovereign liabilities toward assets without counterparty risk. J P Morgan’s widely cited observation that gold is money while everything else represents credit remains analytically relevant because it captures the hierarchy of monetary trust underlying current reserve management behaviour. Central bank reserve data compiled by the Bank for International Settlements demonstrate that official gold holdings have exceeded aggregate dollar holdings for the first time in approximately three decades, indicating a decisive rebalancing within reserve portfolios.

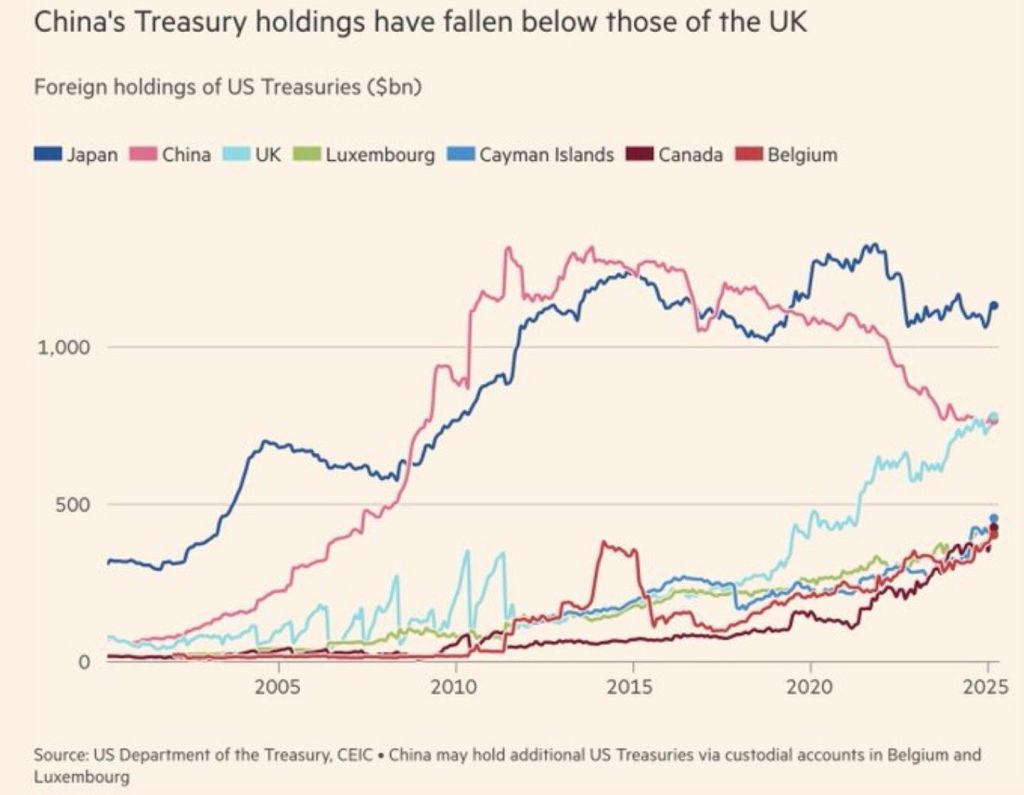

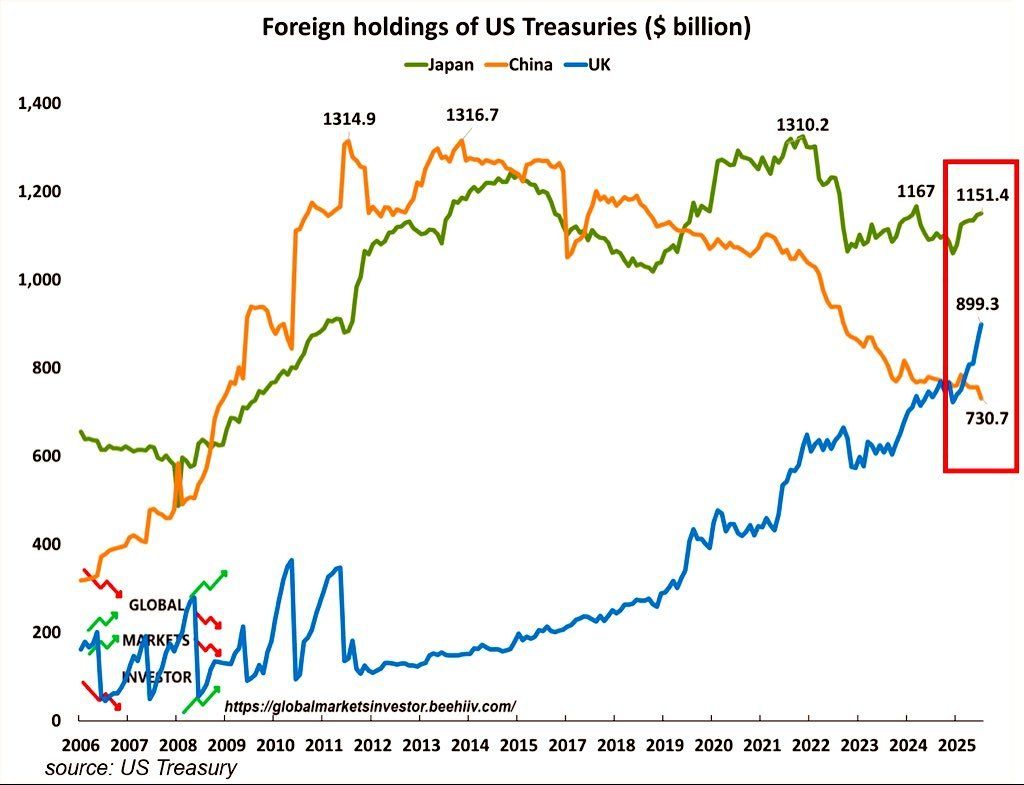

China’s reserve strategy provides the clearest empirical illustration of this shift, as its reported gold holdings reached 74.1 million ounces while United States Treasury holdings declined to approximately 682.6 billion dollars, representing an eighteen year low. Official United States Treasury data confirm that China has reduced its Treasury exposure by more than 600 billion dollars since the 2013 peak, while simultaneously doubling reported gold reserves over the same period. Goldman Sachs analysts have estimated that China’s reported gold purchases significantly understate actual accumulation, suggesting implied acquisitions exceeding ten times reported volumes through non transparent channels. Such accumulation strategies are consistent with research by Barry Eichengreen at the University of California, who has emphasised that reserve diversification increasingly reflects sanction risk rather than yield optimisation. China’s actions align with a broader pattern observed across emerging and middle power states, where gold accumulation functions as insurance against financial weaponisation and payment system exclusion.

Brazilian central bank disclosures indicate acquisition of approximately forty three tonnes of gold within a three month period, bringing total reserves to roughly one hundred seventy two tonnes, reflecting similar diversification incentives. Luís Nassif has documented the operational infrastructure supporting these shifts, including bilateral currency swap lines, non Swift settlement systems, and politically grounded trust mechanisms enabling trade without dollar intermediation. These developments demonstrate that the technical capacity for operating outside dollar settlement already exists, reducing dependence on United States correspondent banking networks over the long term. The concept of de-fiatisation captures the declining credibility of sovereign promises denominated in currencies whose supply expansion has outpaced underlying productive growth. Since the global financial crisis of 2008, advanced economies have normalised balance sheet expansion through quantitative easing, reinforcing perceptions that fiat value rests primarily upon political tolerance rather than economic constraint.

Picton argues that the era of high financialisation reached its terminal phase during the financial crisis, when leverage dependent asset structures required extraordinary state intervention to avoid systemic collapse. The crisis undermined the ideological legitimacy of liberal financial capitalism, particularly among non market economies that interpreted crisis management as evidence of structural fragility. China’s political economy interpretation framed the crisis as confirmation that Western growth relied upon debt accumulation rather than productive investment, strengthening domestic support for alternative development models. The persistence of large United States fiscal deficits following the crisis further entrenched reliance upon foreign capital inflows to sustain consumption and asset valuations. This configuration is structurally constrained by the Triffin Dilemma, which explains why a reserve currency issuer must supply global liquidity by running capital account surpluses.

As Picton notes, attempts by the United States to reduce trade deficits necessarily imply reduced dollar availability for global trade settlement, tightening external dollar liquidity. This tension explains why no alternative sovereign currency, including the Chinese renminbi, can fully replace the dollar without China running sustained trade deficits, which remains politically unacceptable. Academic analyses by Robert Triffin and later by Eichengreen emphasise that reserve currency status creates internal contradictions that erode long term stability. Consequently, de-fiatisation reflects rational adaptation by reserve managers who increasingly doubt the sustainability of expanding sovereign balance sheets across advanced economies. Gold’s appeal derives from its independence from any single issuer’s fiscal trajectory, making it uniquely suited to an environment of rising geopolitical fragmentation.

The geopolitical dimension is critical, because financial architecture has become an explicit instrument of state power through sanctions, asset freezes, and payment system exclusions. United States and allied sanctions against Russia following the Ukraine conflict demonstrated that reserve assets denominated in foreign jurisdictions carry confiscation risk. Studies by the Atlantic Council and independent European monetary institutes have documented how these actions accelerated reserve diversification among non aligned states. The resulting shift is not ideological opposition to the dollar but pragmatic risk management under conditions of geopolitical rivalry. Trade fragmentation further reinforces this trend, as new barriers to goods, capital, and technology flows reduce incentives for holding liquid claims on rival sovereigns.

The United States National Security Strategy has explicitly framed economic relationships within the Western Hemisphere as matters of strategic interest, reviving Monroe Doctrine principles. Tariff threats against Canada over potential trade agreements with China illustrate how economic integration is increasingly subordinated to geopolitical alignment requirements. Statements by United States Treasury Secretary Scott Bessent underline that integrated supply chains are now evaluated through security lenses rather than efficiency considerations. Mark Carney’s Davos remarks acknowledged the erosion of multilateral norms, while his subsequent bilateral trade concessions highlight constraints facing middle powers navigating great power competition. Ray Dalio has warned that capital war dynamics may follow trade conflict escalation, as states seek to influence asset flows rather than merely goods flows.

Such capital conflict would accelerate de-fiatization by incentivising further exit from politically exposed financial instruments. Within this context, rising gold and silver prices reflect not speculative excess but structural revaluation driven by reserve reallocation and declining confidence in fiat purchasing power. Analysts at Rabobank and independent commodity researchers have modelled scenarios where gold prices approach five thousand three hundred dollars per ounce under sustained reserve demand and fiscal stress. Silver projections approaching one hundred fourteen dollars per ounce derive from its dual monetary and industrial characteristics, combined with constrained supply growth and investment demand. These price levels represent equilibrium adjustments under conditions where fiat dilution outpaces productivity and real asset scarcity becomes more salient.

The social implications are best understood through class analysis, because de-fiatisation redistributes wealth away from wage earners toward asset holders and sovereign reserve managers. Inflationary environments disproportionately burden labour incomes, while asset inflation protects capital, reinforcing structural inequality across societies. Historical research by Thomas Piketty demonstrates that periods of monetary instability often coincide with accelerated wealth concentration absent countervailing political intervention. For states, de-fiatisation constrains fiscal capacity, reducing scope for redistributive policy and increasing reliance on coercive mechanisms to maintain social order. The question of war arises because geopolitical conflict has historically functioned as a mechanism for resetting financial hierarchies and legitimising extraordinary fiscal measures.

“We are headed for an economic crisis that will make the 2008 financial crisis seem like a Sunday school picnic.”

He calls it American fuelled but who runs the federal reserve again?

Economic historians including Niall Ferguson have documented how large scale wars enable debt monetisation and political consolidation that would otherwise face domestic resistance. From a systems perspective, chaos theory suggests that highly interconnected financial networks exhibit nonlinear responses to incremental stress, producing sudden regime shifts. Small shocks within over leveraged systems can generate disproportionate outcomes, consistent with observed market volatility and abrupt reserve reallocations. Game theory further illuminates state behaviour, as actors defect from cooperative monetary arrangements when perceived payoffs from unilateral exit exceed collective stability benefits. Under repeated prisoner’s dilemma conditions, rational actors prioritise self insurance over systemic preservation, accelerating fragmentation. In this framework, de-fiatisation represents an equilibrium outcome rather than a transitional anomaly.

Whether the existing empire requires war to survive depends upon its capacity to reconcile fiscal demands with declining monetary privilege without externalising costs through conflict. Absent such reconciliation, historical precedent suggests increased probability of confrontation as a means of restructuring obligations and asserting control over resources and trade routes.

Authored By: Global Geopolitics

This is a reader-supported publication. I cannot do this without your support. If you believe journalism should serve the public, not the powerful, and you’re in a position to help, becoming a PAID SUBSCRIBER truly makes a difference. Alternatively you can support by way of a cup of coffee:

Leave a comment