The Burdem of United States Trade Policy Failure Fell on American Consumers, Firms, Allies, and Markets

The reintroduction and expansion of United States tariffs under the Trump administration formed the centrepiece of a strategy publicly presented as economic nationalism, strategic leverage, and industrial revival. The policy failed on each stated objective while imposing measurable domestic costs and accelerating external realignment among allies and rivals alike. Federal customs and treasury data show American firms remitted approximately USD$260 billion in tariff payments within a single year, representing a tripling of the previous annual burden borne by domestic importers. Chinese counterpart payments across the same tariff regime amounted to roughly USD$7 billion, reflecting the legal structure of tariff incidence where importers, not exporters, carry payment obligations. Michael Pettis of Peking University has repeatedly noted that tariffs function as domestic consumption taxes, stating that “tariffs are paid by domestic residents and redistribute income internally rather than externally.”

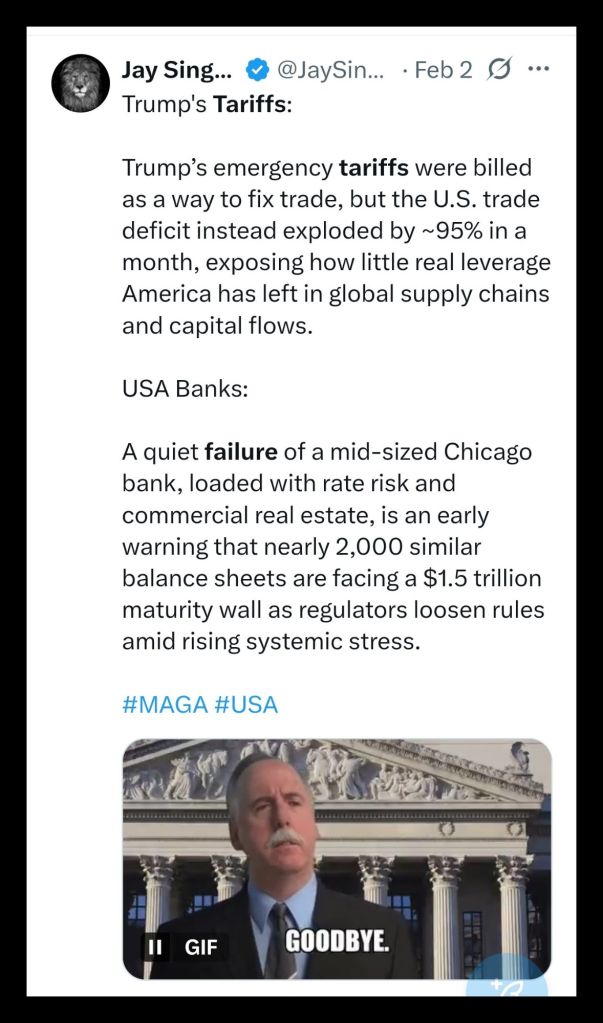

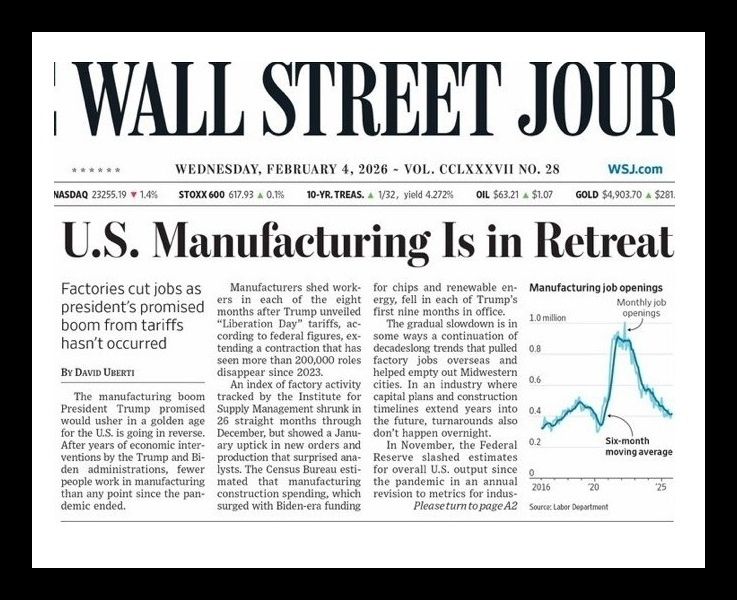

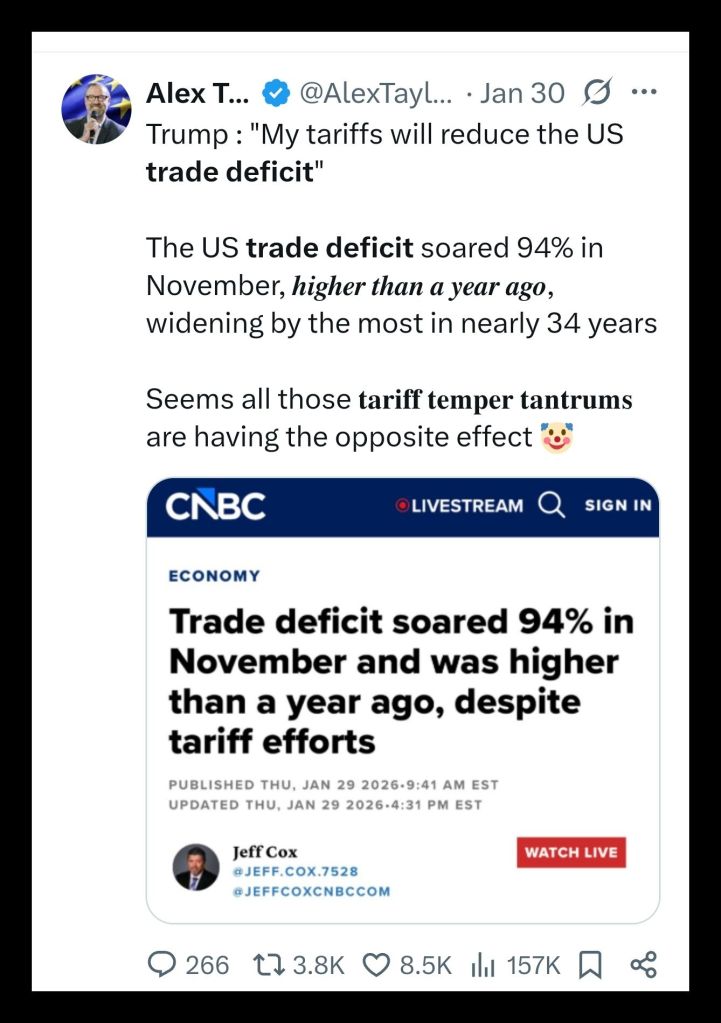

Trump’s strategy assumed foreign exporters would absorb tariff costs through currency adjustment or margin compression. That assumption collapsed almost immediately. Manufacturing input prices rose sharply, with industrial surveys reporting cost increases approaching 40 % for firms dependent on imported intermediate goods. Export performance deteriorated within weeks of escalation, as United States outbound shipments fell 6% within a thirty day period. Merchandise trade balance figures moved in the opposite direction to official promises, with the trade deficit doubling rather than narrowing. Douglas Irwin of Dartmouth College has shown through historical analysis that tariffs fail to improve trade balances when fiscal deficits and savings gaps remain unchanged, a condition fully present during this period.

Allied reaction exposed the strategic miscalculation embedded within the tariff regime. Canada responded with targeted retaliation on steel, aluminium, and agricultural products while initiating World Trade Organisation proceedings. The European Union imposed counter tariffs on American motorcycles, bourbon, and industrial goods, explicitly framing the response as defence against unilateral coercion. British officials warned parliamentary committees that United States trade unpredictability undermined post Brexit supply planning. BRICS economies accelerated intra bloc settlement mechanisms and trade agreements, reducing exposure to United States trade pressure. Former Canadian foreign minister Chrystia Freeland stated publicly that “tariffs framed as national security threats against allies undermine trust and economic stability.”

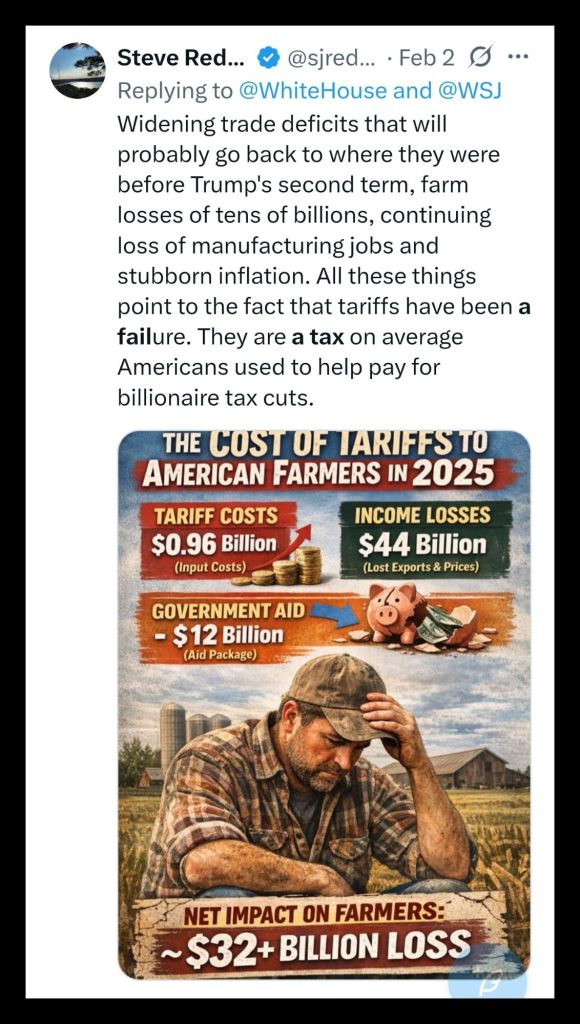

Beijing’s response proved more structurally effective than Washington anticipated. Retaliatory tariffs targeted politically sensitive export sectors, particularly agriculture, collapsing United States soybean access to Chinese markets. Emergency treasury subsidies followed, transferring fiscal costs onto taxpayers. Adam Smith’s observation that defence outweighs opulence offers little comfort when defence policy requires permanent fiscal compensation. Treasury disbursements exceeded tariff revenue gains, erasing claims of net fiscal benefit.

China has been using financial tools strategically instead of direct confrontation to influence global markets. Its holdings of U.S. Treasury securities have been gradually reduced over time, falling to around $682.6 billion by November 2025, the lowest level since 2008. This slow reduction reflects a strategy of diversifying reserves, for example, buying more gold, rather than selling off everything at once. Since the start of 2025, China’s Treasury holdings have declined by more than 10 %, highlighting a careful shift in its approach to managing foreign assets and reducing exposure to U.S. government debt. Barry Eichengreen of Berkeley has explained that even modest rebalancing of reserve portfolios by large holders can raise funding costs and weaken currency confidence. Treasury yield volatility increased during escalation phases, coinciding with tariff announcements and currency designation threats. Glen Diesen has argued that economic coercion accelerates counter strategies rather than compliance, particularly when alternatives exist.

Financial markets have been strongly affected by policy and geopolitical tensions in 2025 and 2026. In October 2025, U.S. stock markets dropped sharply: the Dow Jones fell over 500 points, and the S&P 500 and Nasdaq also declined as investors worried about trade conflicts and mixed economic data. In one day, U.S. equities lost around $2.7 trillion in total value, showing how quickly markets can react to uncertainty. Commodity prices were also volatile. Metals and energy costs changed sharply as supply chains and global demand shifted, and gold and silver fell 5–7 % in early February 2026 after signals that interest rates would stay high for longer. Agricultural markets were affected too, particularly when China reduced imports of U.S. farm products. Measures of market uncertainty, like the VIX index, spiked repeatedly, showing that investors were pricing in higher risk across stocks, commodities, and derivatives.” Prices for industrial metals swung sharply as global supply chains adjusted to shifting trade and production conditions. Agricultural futures declined in response to reduced export opportunities, highlighting the impact of disrupted trade flows rather than protective policies. Meanwhile, derivatives markets reflected heightened uncertainty, with volatility indices rising and credit spreads widening in sectors most exposed to international trade. The Bank for International (BIS) Settlements warned that tariff driven fragmentation increased systemic risk through correlated shocks across commodities, currencies, and credit markets.

Currency manipulation accusations formed a central rhetorical pillar of the tariff strategy. Treasury criteria relied upon bilateral trade surpluses, current account thresholds, and alleged intervention volumes. Chinese currency movement remained within 3% over the period, far below the competitiveness shock imposed by tariff driven cost increases faced by United States exporters. Nouriel Roubini described the episode as “economic warfare dressed as trade policy,” emphasising the self inflicted nature of the resulting instability.

The scope of enforcement expanded beyond rivals. Japan, Germany, Switzerland, and South Korea appeared on monitoring lists despite advanced financial systems and alliance commitments. Dani Rodrik of Harvard University has argued that economic nationalism without domestic reform produces fragility rather than resilience. Companies accelerated supply chain diversification away from U.S. markets, prioritising stability and predictability. At the same time, foreign direct investment inflows slowed due to policy uncertainty, casting doubt on expectations of a manufacturing resurgence.

The impact on consumers became unavoidable, as rising grocery and fuel costs combined with higher prices for electronics, reflecting broader pressures across supply chains and global markets. Congressional Budget Office analysis showed disproportionate impact on lower income households, consistent with regressive tax characteristics. Layoff figures reached the highest January levels since two thousand nine, coinciding with tariff uncertainty. Joseph Stiglitz warned that tariffs resemble consumption taxes without social insurance buffers, amplifying inequality through price transmission.

Despite official goals of maintaining access to traditional markets, China’s policies led to a reorientation of exports toward Southeast Asia, Africa, and Latin America, highlighting a gap between intended objectives and actual outcomes. Dollar weakness emerged during escalation phases rather than strength. Reserve diversification discussions gained momentum among emerging economies. Albert Hirschman’s work on economic coercion warned that targets adapt faster than initiators expect, eroding leverage over time.

Beyond headline trade and fiscal measures, institutional and market level data further underline the scale of disruption created by tariff escalation. United States equity markets experienced repeated drawdowns concentrated in industrials, semiconductors, agriculture, and transport firms with direct trade exposure. Volatility indices rose materially following tariff announcements, reflecting repricing of policy risk rather than underlying economic fundamentals. Base metals markets recorded sharp dislocations as aluminium and steel premiums diverged across regions, while copper prices reflected weakening forward demand expectations. Agricultural futures priced permanent market loss rather than temporary disruption, signalling confidence erosion among producers and counterparties. Derivatives linked to global trade volumes widened spreads, while freight rates and shipping insurance costs adjusted upward, imposing additional non tariff costs across supply chains.

The evidence demonstrates that Trump’s tariff strategy failed to rebalance trade, revive manufacturing, or strengthen strategic leverage. Scott Bessent’s public defence of tariff escalation as a negotiating tool ignored empirical outcomes and market signals. John Maynard Keynes warned against policies driven by political expediency rather than economic coherence, noting that “practical men are slaves of defunct economists.” The tariff regime reflected mercantilist assumptions unsuited to modern production networks and capital mobility. Domestic households, firms, and financial markets absorbed costs attributed publicly to foreign adversaries. The consequences include weakened alliances, distorted markets, fiscal leakage, and reduced strategic credibility.

Authored By: Global GeoPolitics

Thank you for visiting. This is a reader-supported publication. You can support by way of a cup of coffee:

https://buymeacoffee.com/ggtv or

https://ko-fi.com/globalgeopolitics

References

Pettis, Michael. Trade Wars Are Class Wars: How Rising Inequality Distorts the Global Economy and Threatens International Peace. Yale University Press.

Irwin, Douglas A. Clashing Over Commerce: A History of US Trade Policy. University of Chicago Press.

Irwin, Douglas A. “Tariffs and the Great Depression Revisited.” World Trade Review, Cambridge University Press.

Rodrik, Dani. Straight Talk on Trade: Ideas for a Sane World Economy. Princeton University Press.

Rodrik, Dani. “What Do Trade Agreements Really Do?” Journal of Economic Perspectives.

Eichengreen, Barry. Globalizing Capital: A History of the International Monetary System. Princeton University Press.

Eichengreen, Barry. “The Weaponization of Trade and Finance.” Project Syndicate commentary archive.

Hirschman, Albert O. National Power and the Structure of Foreign Trade. University of California Press.

Roubini, Nouriel. Public commentary and interviews on trade escalation and global financial stability, 2018–2020.

Stiglitz, Joseph E. Globalization and Its Discontents Revisited. W. W. Norton & Company.

Smith, Adam. An Inquiry into the Nature and Causes of the Wealth of Nations. Book IV.

Keynes, John Maynard. The General Theory of Employment, Interest and Money. Macmillan.

Bank for International Settlements. Annual Economic Report, multiple editions covering trade fragmentation and market volatility.

Congressional Budget Office. The Budgetary and Economic Effects of Tariffs, analytical briefings.

United States Census Bureau. U.S. International Trade in Goods and Services, annual and monthly reports.

United States Department of the Treasury. Treasury International Capital System (TIC) Data.

Federal Reserve Board. Financial Stability Report, sections on trade policy uncertainty.

Diesen, Glenn. Great Power Politics in the Fourth Industrial Revolution. I.B. Tauris.

Economic Times. “US Stock Market Today: Massive Market Crash.” October 2025.

Economic Times. “Wall Street Crash Shaves Off $2.7 Trillion in One Day.” October 2025.

Reuters. “Slump in Commodities Rattles Global Markets.” February 2026.

Economic Times, October 2025. “US Stock Market Today: Massive Market Crash.” Link

Economic Times, October 2025. “Wall Street Crash Shaves Off $2.7 Trillion in One Day.”

Reuters, February 2026. “Slump in Commodities Rattles Global Markets.

Global Times, November 2025. “China’s U.S. Treasury Holdings Hit Lowest Since 2008.

Freeland, Chrystia. Public statements and parliamentary testimony on retaliatory trade measures, Government of Canada.

Leave a comment