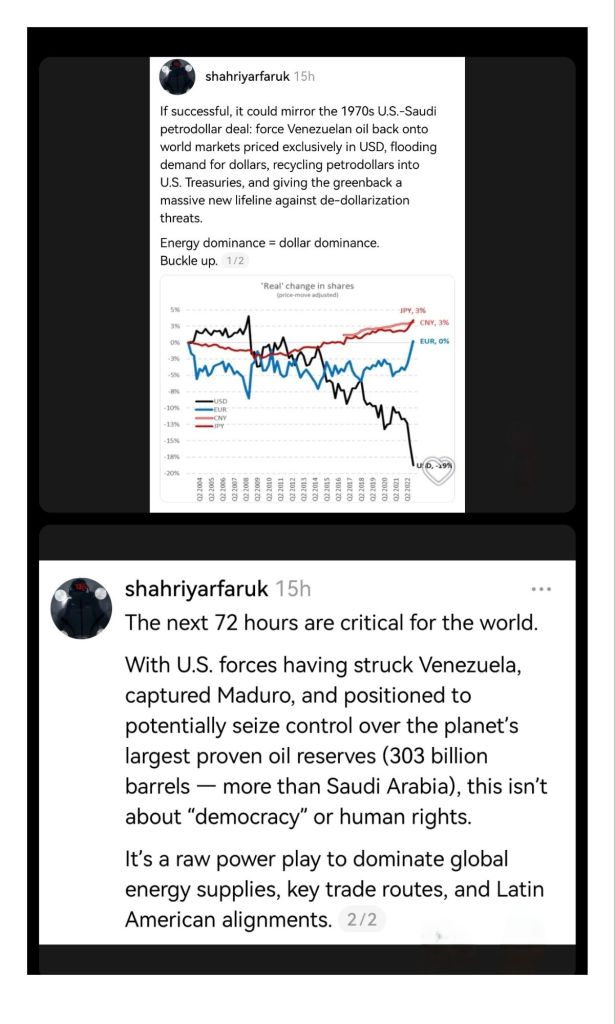

How energy control sustains petrodollar power against multipolar challengers, China, Russia, BRICS expansion, and alternative payment systems

The removal of Venezuela’s head of state formed part of a broader contest over the architecture of global payments, energy settlement, and monetary hierarchy. The operation did not arise from humanitarian urgency, democratic reform, or governance failure. Strategic pressure focused instead on a state occupying a key position within alternative trade and settlement networks that increasingly bypass dollar clearing and United States financial supervision.

Public admissions by senior United States officials clarified the absence of structural change following leadership removal. Secretary of State Marco Rubio stated that “all of the problems we had with Maduro when Maduro was there, we still have those problems,” confirming continuity of policy objectives rather than transition or reform. Sanctions, oil restrictions, and conditional relief remained intact, demonstrating that the target involved system alignment rather than individual leadership behaviour. Such continuity aligns with earlier United States interventions where regime change served as an instrument for enforcing compliance within a wider financial and energy order.

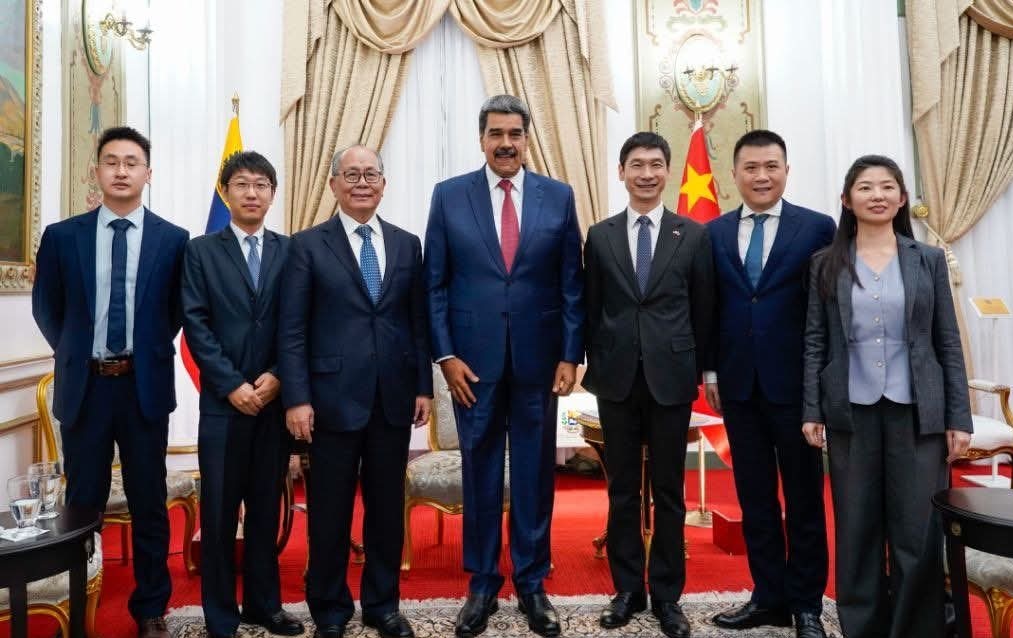

Venezuela’s strategic value lies in energy reserves, settlement pathways, and participation in emerging multipolar trade structures. Venezuela holds the largest proven oil reserves globally and has increasingly settled oil exports outside dollar mechanisms through yuan-denominated contracts, barter arrangements, and bilateral clearing systems. Analysts including Michael Hudson have long described dollar hegemony as dependent upon energy pricing, reserve currency recycling, and sanctions enforcement rather than market neutrality. Oil transactions conducted outside dollar clearing reduce demand for United States debt instruments and weaken sanction leverage across the Global South.

China’s energy dependence amplifies Venezuela’s importance within this framework. China purchases between sixty and ninety percent of Venezuelan oil exports, alongside approximately eighty-five to ninety percent of Iranian crude, together accounting for roughly one third of Chinese oil imports. Additional Middle Eastern supply routes remain exposed to United States naval and financial pressure, giving Washington potential influence over close to seventy percent of China’s energy flows. Strategic analysts including J. Michael Waller argue that constraining Chinese energy security restricts Beijing’s capacity for high-risk military operations, particularly regarding Taiwan, while increasing pressure on Russia through forced price concessions on oil exports.

Energy dominance intersects directly with currency dominance. Settlement in dollars underpins United States fiscal sustainability through reserve demand and Treasury absorption. Both Democratic and Republican administrations have treated de-dollarisation as a strategic threat, regardless of rhetorical differences. Independent observers including Hudson and Glenn Diesen describe sanctions policy as a substitute for industrial competitiveness, relying on financial choke points rather than productive capacity. Control over banking rails, insurance markets, maritime corridors, and reserve currency issuance enables coercive enforcement without formal declarations of war.

The Venezuela operation occurred without multilateral authorisation and outside declared conflict, signalling willingness to bypass institutional constraints when financial interests face erosion. Pepe Escobar characterised the move as a “structural rupture,” reflecting desperation rather than confidence. Political economy theory distinguishes between confident hegemons that promote open systems and declining hegemons that weaponise access, a framework articulated by Diesen and echoed by multiple non-aligned scholars. Declining hegemons restrict technology transfer, sever currency access, and enforce compliance through sanctions, asset seizures, and regime pressure.

Sanctions imposed on Venezuela functioned less as corrective tools and more as mechanisms of enforced disconnection. Oil production, refining capacity, and export logistics remained constrained under United States licensing regimes even after leadership removal. Rubio’s remarks confirmed that relief would remain conditional upon Washington-defined benchmarks subject to revision. Such arrangements preserve leverage while preventing independent reconstruction or reintegration into alternative financial systems.

Claims framing the operation as democratic intervention conflict with outcomes on the ground. Institutional structures, security forces, and economic controls remained unchanged, while sanctions continued to suppress domestic energy revenues. Independent analysts described the action as “cosmetic,” removing a public figure while leaving the underlying economic siege intact. Continuity rather than reform characterised post-removal policy, reinforcing the assessment that sovereignty rather than governance lay at issue.

The broader geopolitical signal extended beyond Venezuela. Latin American governments now face recalculated risk assessments regarding currency exposure, energy partnerships, and political alignment. Zhao DaShuai emphasised the reality of power projection constraints for China and Russia, noting the absence of regional military infrastructure capable of countering United States action in the Western Hemisphere. Geographic distance, logistical barriers, and escalation risk limit external intervention options despite political sympathy or economic ties.

Energy markets and foreign exchange systems responded accordingly. Venezuelan oil assets, sovereign credit risk across Latin America, and emerging market debt instruments underwent repricing as investors reassessed United States willingness to enforce compliance through direct action. Petrodollar and petro-yuan narratives gained renewed attention, reflecting concerns regarding settlement safety and asset seizure risk. Gold and non-sovereign stores of value gained narrative strength, not as immediate price reactions but as long-term hedges against unilateral enforcement.

The operation also reinforced precedent regarding international law and institutional bypass. United States action occurred without Security Council authorisation and with explicit acknowledgement of regime removal objectives. Independent legal scholars have described such conduct as consistent with rogue state definitions, prioritising self-interest over norm adherence. Under previous administrations, similar objectives operated under humanitarian or democratic rhetoric, whereas current practice reflects reduced concern for narrative cover.

China and Russia face limited response options under these conditions. Military intervention remains implausible given distance and escalation risk. Economic retaliation risks further sanction exposure. Diplomatic condemnation carries minimal deterrent effect absent enforcement capability. Such asymmetry underscores the continued effectiveness of dollar-centred coercion despite increasing multipolar rhetoric.

The Venezuela case therefore illustrates the operational mechanics of financial warfare during a period of hegemonic transition. Energy control, settlement enforcement, and sanction leverage converge to discipline states attempting currency diversification or strategic autonomy. Leadership removal functions as one instrument within a broader toolkit designed to preserve system compliance rather than institutional reform.

An additional dimension emerges through the immediate seizure and monetisation of Venezuela’s precious metals base, which aligns financial market stress with kinetic action. United States authorities moved within twenty-four hours to secure control over an estimated one trillion dollars in Venezuelan gold and silver, finalising an eight billion dollar smelting project designed to process large volumes from the Arco Minero region. Financing reportedly originated from JPMorgan, with the United States Department of Defense holding a substantial equity stake, indicating direct state–financial coordination rather than post-conflict opportunism. The timing coincided with severe dislocation in the silver market, where major banks, including JPMorgan, incurred significant losses on short positions tied to physical silver supply constraints. China’s near-immediate imposition of export restrictions on silver reinforced global supply tightening, amplifying pressure on Western financial institutions exposed to synthetic metal markets dependent on stable physical flows. Analysts noted that planning for the smelting facility predated the military operation, implying prior knowledge of regime removal and guaranteed access to feedstock. Removal of political barriers in Caracas cleared long-restricted foreign access to Venezuela’s undeveloped precious metal reserves, converting sovereign assets into stabilising inputs for distressed bullion markets. This sequence links leadership removal, resource seizure, and financial market repair within a single operational logic, extending the defence of the petrodollar beyond oil settlement into control of strategic metals underpinning collateral, liquidity, and confidence across the dollar-centred financial system.

Recommendations follow from these observations rather than ideological preference. States seeking autonomy within a multipolar order require redundancy across energy supply, settlement mechanisms, logistics, and financial infrastructure. Diversification alone proves insufficient without coordinated protection of trade corridors and insurance systems. Regional blocs require internal clearing arrangements insulated from external seizure risk. Industrial capacity and technological independence reduce vulnerability more effectively than diplomatic alignment. Absent such measures, participation in alternative monetary systems remains exposed to enforcement actions exemplified by the Venezuela operation.

Authored By: Global GeoPolitics

If you believe journalism should serve the public, not the powerful, and you’re in a position to help, becoming a PAID SUBSCRIBER truly makes a difference. Alternatively you can support by way of a cup of coffee:

buymeacoffee.com/ggtv

Leave a comment