Monetary Systems, Power, and the Struggle to Shape and Control the Global Order for the Coming Generations

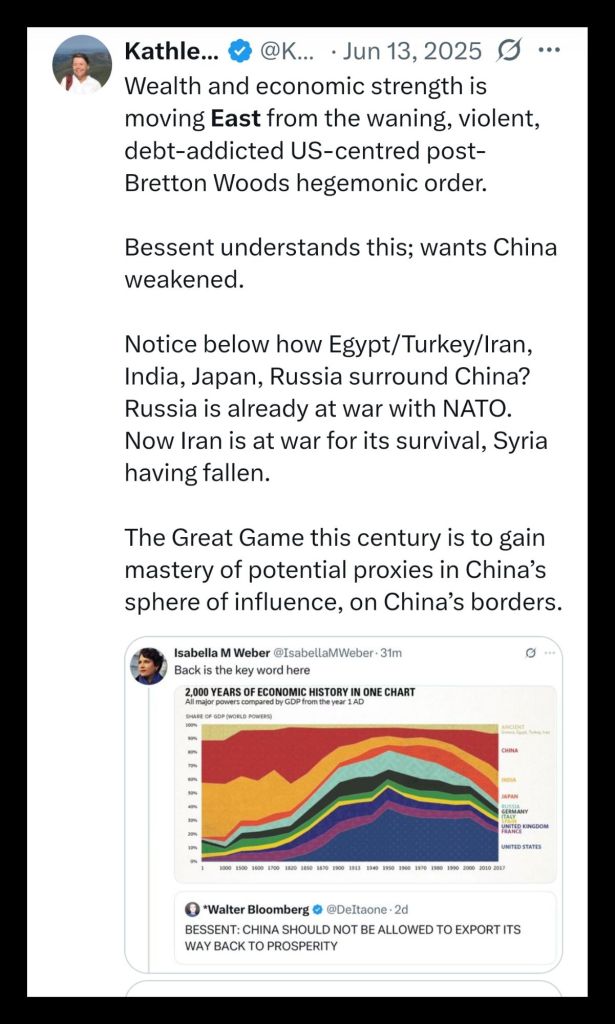

West versus East; it is a war, for now, a smart kind of war, but one that results in a “permanent fragmentation” of the global financial architecture. This architecture that evolved after the Second World War rested upon the United States dollar as the primary international medium of exchange, reserve asset, and settlement currency. That structure provided liquidity, trade settlement efficiency, and capital market depth that supported post-war reconstruction and later globalisation. The dollar’s dominance is rooted in institutional design, geopolitical power, and enforcement authority, with market neutrality self-regulating markets playing a secondary role. Barry Eichengreen of the University of California notes that reserve currency status depends less on confidence alone than on “the geopolitical and military reach of the issuing state, and its ability to enforce contracts and norms” (Eichengreen, Exorbitant Privilege).

Over time, that system became increasingly coercive as access to dollar liquidity, correspondent banking, and settlement infrastructure was conditioned on political alignment. The freezing of sovereign reserves, exclusion from SWIFT messaging, and extraterritorial sanctions transformed financial infrastructure into a strategic weapon. Michael Hudson has written that “finance has become the modern form of warfare, replacing armies with sanctions, and bullets with balance sheets” (Hudson, Super Imperialism). This shift altered incentives for states operating outside the Western alliance structure.

In response, parallel payment and settlement systems emerged as instruments of economic survival rather than ideological defiance. China’s Cross-Border Interbank Payment System and Russia’s System for Transfer of Financial Messages expanded following sanctions escalation after 2014 and accelerated after 2022. These systems were designed to reduce dependency on Western-controlled infrastructure rather than immediately replace it. Former Chinese central bank adviser Yu Yongding stated that “financial sovereignty requires payment independence, or monetary policy becomes hostage to external decisions” (Yu Yongding, Chinese Academy of Social Sciences).

From a game theory perspective, this transition reflects a classic prisoner’s dilemma dynamic under asymmetric power. Continued reliance on dollar systems offers short-term efficiency but exposes participants to high-impact tail risks. Defection toward alternatives imposes short-term costs but reduces catastrophic exposure. Repeated sanctions episodes altered payoff matrices by demonstrating that compliance did not guarantee immunity. Adam Tooze observed that “the dollar system is stable until it is used coercively, after which participants begin planning exits” (Tooze, Crashed).

The United States response has not been neutral adaptation but strategic pre-emption. Rather than allowing alternative systems to mature gradually, Washington has escalated financial pressure across multiple vectors simultaneously. Sanctions intensity increased, trade frictions widened, and supply chains were deliberately stressed. Former US Treasury official Juan Zarate described this approach as “turning the financial system into a battlefield where access itself becomes leverage” (Zarate, Treasury’s War). This reflects a denial strategy rather than competitive coexistence.

Art of War doctrine provides a useful analytical frame for understanding this behaviour. Sun Tzu wrote that “the supreme art of war is to subdue the enemy without fighting” and that victory is achieved by attacking strategy, alliances, and logistics before armies meet. Financial infrastructure functions as logistics for modern economies. Disrupting settlement, liquidity, and credit denies opponents the ability to mobilise resources. The United States has targeted trust, timing, and coordination rather than attempting to out-innovate alternatives directly. Sun Tzu further warned that forcing an enemy into premature action exposes structural weaknesses. Accelerating stress before rival systems mature reflects this principle.

Chaos theory further explains the emphasis on inducing disorder rather than preserving stability. Complex adaptive systems such as global finance do not fail linearly. Small shocks introduced at critical nodes can cascade into systemic breakdowns. The deliberate concentration of shocks across trade, energy, shipping, and finance increases the probability of non-linear collapse. Hyman Minsky’s financial instability hypothesis supports this dynamic, arguing that prolonged stability breeds fragility, while sudden liquidity withdrawal exposes leverage and hidden dependency. The objective becomes timing rather than equilibrium.

Gold and silver markets represent a parallel battlefield within this broader confrontation. Precious metals function simultaneously as commodities, monetary hedges, and political signals. Eastern states have accumulated physical gold aggressively over the past decade while reducing exposure to dollar-denominated reserves. According to World Gold Council data, central bank gold purchases reached record levels in 2022 and 2023, driven primarily by non-Western buyers. Russian central bank officials previously stated that “gold provides financial insurance against geopolitical risk” and remains “free from counterparty control.”

Western financial centres, by contrast, dominate paper gold and silver markets through futures, unallocated accounts, and derivative instruments. These markets set global prices while relying on fractional physical backing. Alasdair Macleod has argued that “paper gold suppresses price discovery while masking physical shortages, allowing Western systems to manage inflation optics without surrendering monetary control” (Macleod, GoldMoney). This divergence creates a structural conflict between physical accumulation in the East and price management in the West.

Silver occupies a similar but more industrially sensitive position. China dominates silver refining, solar demand, and industrial consumption, while Western exchanges continue to price silver primarily as a financial asset. Disruptions to physical supply chains expose vulnerabilities in derivative pricing mechanisms. Jeffrey Christian of CPM Group has acknowledged that “paper silver markets depend on confidence that physical delivery will not be demanded at scale,” a condition that fails during systemic stress. Physical drawdowns therefore function as a stress test on Western price-setting power.

This confrontation in metals markets mirrors broader maneuvers in the currency and trade arena, epitomized by what analysts have termed “Plaza Accord 2.0.” The United States, constrained by a public debt exceeding $36 trillion and persistent trade deficits, is now deploying an unusually aggressive combination of dollar depreciation and heavy tariffs aimed at undermining China’s economic momentum. A 50% decline in the dollar would immediately double the cost of imported goods for Americans, effectively “burning its own house” while attempting to impose stress on China. Unlike Japan in 1985, China possesses military sovereignty, capital controls, and parallel payment systems such as mBridge and CIPS, allowing trade with developing economies independent of the dollar. Coupled with its Dual Circulation strategy, China is positioned to withstand external shocks while the United States risks domestic inflation, higher living costs, and social strain. In this context, the strategy is less about China’s collapse than a test of endurance, one where tangible assets, resource control, and decentralized systems like gold and Bitcoin serve as havens, underscoring the growing fragmentation of the global financial system and the limits of dollar-centric coercion.

These metals markets align with broader material realities. Money functions as a claim on goods, energy, and labour rather than as an abstract promise alone. When confidence in financial claims erodes, participants seek tangible stores of value. David Graeber noted that “debt systems persist only so long as enforcement outweighs resistance, but collapse returns value to the physical world” (Debt: The First 5,000 Years). Industrial capacity, supply chains, and resource control then outweigh ledger balances.

This material dimension undercuts assumptions that digital settlement alone guarantees monetary dominance. A programmable currency without access to production or commodities cannot sustain demand. Monetary velocity depends on utility rather than compliance. The comparison between financial claims and real goods becomes unavoidable during credit contraction. As economic historian Niall Ferguson has stated, “reserve currencies fall not when alternatives are perfect, but when issuers lose relative productive advantage.”

The emerging financial order therefore reflects a contest between financial leverage and material gravity. Western systems retain control over credit, pricing, and enforcement, while Eastern systems retain control over manufacturing, resources, and physical supply chains. Neither side holds total dominance. The outcome depends on endurance under stress rather than theoretical superiority.

In this context, the global financial conflict reflects deliberate strategic choices embedded within the existing monetary and geopolitical framework. The dollar-based system carries structural debt burdens, expanding liabilities, and growing political commitments that exceed its productive base. Historical experience shows that monetary systems with these characteristics resolve through forced adjustment under conditions of systemic stress. The direction of that adjustment depends on how states manage liquidity stress, asset security, and access to material supply when confidence in financial claims weakens. As Charles Kindleberger observed, “financial crises are resolved not by restoring confidence, but by reallocating losses.” As Fernand Braudel wrote, “the real economy endures, while monetary structures change above it.”

Authored By: Global Geopolitics

Thank you for visiting. This is a reader-supported publication. I cannot do this without your support. You can support by way of a cup of coffee:

buymeacoffee.com/ggtv or

https://ko-fi.com/globalgeopolitics

References

- Eichengreen, Barry. Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System.

- Hudson, Michael. Super Imperialism: The Economic Strategy of American Empire.

- Yu, Yongding. Chinese Academy of Social Sciences, statements on financial sovereignty.

- Tooze, Adam. Crashed: How a Decade of Financial Crises Changed the World.

- Zarate, Juan. Treasury’s War: The Unleashing of a New Era of Financial Warfare.

- Sun Tzu. The Art of War.

- Minsky, Hyman. Financial instability hypothesis (various works).

- World Gold Council. Central bank gold purchase statistics (2022–2023).

- Macleod, Alasdair. GoldMoney commentary on paper gold and price discovery.

- Christian, Jeffrey. CPM Group commentary on silver markets.

- Graeber, David. Debt: The First 5,000 Years.

- Ferguson, Niall. Commentary on reserve currency and productive advantage.

- Kindleberger, Charles. Commentary on financial crises and loss reallocation.

- Braudel, Fernand. Commentary on the endurance of the real economy versus monetary structures.

Leave a comment