The region braces for war as U.S.-Israel-Iran conflict could start at any moment, affecting both regional security and global markets.

The confrontation involving Iran, the United States, and Israel has reached a stage where military forces are positioned for rapid action, diplomatic efforts are secondary to military readiness, and the risk of escalation depends largely on timing and miscalculation rather than deliberate strategy. The situation represents an advanced pre-war phase marked by deployed naval forces, active air operations, increased intelligence activity, high alert levels across several regions, and widespread regional expectation of possible armed conflict. This military readiness coincides with growing strain in global financial and energy markets, reflected in rising demand for gold and silver, higher risk pricing, and increasing concern over severe disruption to oil supply and prices if fighting begins.

The situation has intensified following the failure of externally supported unrest within Iran to generate regime change, which removed a non-military pathway previously favoured by Washington and Tel Aviv. Subsequent American and Israeli posturing has increasingly relied upon overt military signalling, asset deployment, and coercive diplomacy, while encountering growing resistance from regional partners previously assumed to be compliant.

Iran’s strategic position rests upon several structural characteristics repeatedly highlighted by Western military and intelligence professionals. Iran possesses a large standing military force with extensive domestic legitimacy, supported by a population that has endured decades of sanctions, covert warfare, and military threats without fracturing internal cohesion. Analysts within American defence institutions have long acknowledged that Iran’s depth of trained engineers, scientists, and technical specialists provides enduring strategic resilience, particularly under conditions of prolonged confrontation. This human capital has allowed Iran to domestically develop missile platforms, unmanned aerial systems, and hardened infrastructure without reliance upon vulnerable external supply chains.

Some pro-war analysts argue that Iran’s strategy reflects existential threat behaviour that must be countered aggressively before it obtains a decisive military advantage. Daniel Pipes, a long-time commentator on Iranian geopolitics, has argued that support for internal opposition forces such as the People’s Mujahedin of Iran represents a necessary component of countering Tehran’s regime and that reluctance to confront tehran militarily risks empowering it further. Pipes has written that dissident groups “pose no danger to Americans or Europeans” but threaten theocratic rule in Tehran and should be encouraged if the West aims to change Tehran’s calculus. These voices frame confrontation with Iran as a strategic necessity rather than optional policy.

Iran’s military posture reflects sustained preparation rather than reactive improvisation. While neighbouring Gulf states invested heavily in consumer infrastructure and financial services during periods of relative stability, Iran allocated resources toward asymmetric warfare capabilities, underground facilities, hardened command structures, and redundant logistics. Systems such as the Muhajir drone series and Zulfiqar missile platforms emerged from this strategic orientation, alongside extensive tunnel networks integrated into mountainous terrain. Western defence assessments frequently describe Iranian geography as uniquely unfavourable for air-dominant military campaigns, particularly when combined with distributed command structures and redundancy.

Israel’s exposure within any direct confrontation remains a central constraint shaping American decision-making. Israeli defence analysts have repeatedly warned that large-scale Iranian retaliation would overwhelm interception capacities, particularly following the degradation of Israel’s air defence performance during the 2025 exchange. That episode concluded only after American intervention sought to contain escalation through a ceasefire, prompted by Israeli interception shortfalls against Iranian retaliatory salvos. Subsequent reports of Israeli diplomatic outreach to Russia, including direct engagement by Prime Minister Netanyahu with President Vladimir Putin, reflected urgent efforts to restrain Iranian escalation rather than confidence in Israeli defensive sufficiency.

American military infrastructure across the Middle East represents an additional vulnerability frequently emphasised by United States Central Command planners. Bases in Iraq, Syria, Jordan, Bahrain, and Qatar exist within range of Iranian missile forces and allied resistance movements. Regional governments have increasingly expressed reluctance to permit their territory or airspace to be used for attacks upon Iran, reflecting fears of retaliatory strikes against critical energy infrastructure and urban centres. Saudi Arabia and the United Arab Emirates publicly communicated refusals to grant airspace access, with Saudi Crown Prince Mohammed bin Salman directly conveying this position to Iranian President Masoud Pezeshkian.

These refusals reflect lessons learned from prior episodes, notably the 2019 attacks upon Saudi oil facilities attributed to Iran or affiliated forces, which demonstrated both vulnerability and the absence of effective American retaliation. Analysts such as Karim Sadjadpour have noted that while Gulf monarchies would benefit from a weakened Iran, none wish to absorb the immediate costs of retaliation or regional instability. Kuwait University scholar Bader Al-Saif emphasised that investment-driven regional strategies depend upon perceived stability, not so much of regime-change experiments with uncertain outcomes.

Iran’s regional alliances further complicate any military calculus. Tehran maintains operational relationships with Hezbollah in Lebanon, Hamas in Palestine, and the Houthis in Yemen, alongside Iraqi and Syrian allied formations. These groups operate with varying degrees of autonomy but share strategic alignment against American and Israeli military presence. Houthi leadership has explicitly warned of renewed maritime targeting should Iran be attacked, directly threatening Red Sea and Gulf shipping lanes critical to global trade. Such escalation would impose immediate economic costs beyond the immediate theatre of conflict.

International alignment patterns increasingly favour Iran under conditions of Western escalation. China has conducted repeated military cargo flights into Iran, widely interpreted by defence analysts as logistics or intelligence support signalling. Russia, North Korea, Pakistan, and China share overlapping incentives to prevent another Western-led regime-change operation, particularly one that would reinforce American credibility after setbacks elsewhere. The principle that adversaries of a common opponent will coordinate materially has been repeatedly observed in contemporary conflict dynamics, including Ukraine and the Korean Peninsula.

Recent intelligence indicators suggest a shift in Iranian early warning and detection capabilities. On January fourteenth, Iran abruptly closed its airspace, a decision that strongly implied foreknowledge of imminent military action. Unlike the 2025 attacks on Iranian nuclear facilities, which achieved strategic surprise, this closure indicated successful interception of operational signals. American analysts acknowledged that once strategic surprise is lost, the asset requirements, escalation risks, and political costs of attack increase substantially. This intelligence evolution likely contributed to the reported postponement of American strike plans.

Publicly reported movements of American assets continue to signal preparation rather than de-escalation. Carrier strike groups, F-15E squadrons stationed in Jordan, missile defence deployments, and potential long-range bomber options from Diego Garcia or the continental United States all remain available. Retired generals such as David Deptula and Joseph Votel have emphasised that while Gulf refusals complicate operational planning, they do not eliminate strike feasibility. However, both have stressed that meaningful military outcomes would require sustained campaigns lasting weeks or months, rather than symbolic or limited strikes.

Critics of war, including prominent analysts outside immediate military circles, frame confrontation as deeply hazardous. Turkey’s Foreign Minister Hakan Fidan urged the United States to resolve disputes incrementally and to avoid military intervention, warning that renewed conflict would be disastrous for the region. He emphasised that Iran is open to nuclear talks, and that diplomacy, not war, offers a pathway to reduce tensions.

Direct expert commentary from the Middle East Institute’s Alex Vatanka states that Iran has “so much to lose in a short-term war,” describing conflict with the United States and Israel as an existential threat to the Islamic Republic’s survival. Vatanka argues that Iranian restraint in not exacting immediate revenge for military losses suggests Tehran’s priority is preservation rather than escalation. Raz Zimmt of the Institute for National Security Studies has similarly observed that Iran avoids actions that might trigger full-blown war, instead opting for use of its asymmetric capabilities “to reduce the possibility of Iranian casualties and significant asset damage inside the country.”

The economic implications of such a conflict extend beyond regional boundaries. Independent commodity analysts have modelled scenarios in which a major Middle Eastern war triggers extreme disruptions in energy markets, shipping insurance, and currency stability. Under such conditions, gold prices reaching approximately five thousand three hundred dollars per ounce and silver approaching one hundred and fourteen dollars per ounce have been presented as plausible outcomes, reflecting capital flight from fiat systems into perceived stores of value. These projections are grounded in historical correlations between large-scale conflict, sovereign debt expansion, and precious metals appreciation, rather than speculative enthusiasm.

The question of whether the American-led system requires war to sustain itself has been examined by political economists and international relations scholars without rhetorical framing. Several argue that prolonged financialisation, debt accumulation, and declining industrial capacity have increased reliance upon military primacy to preserve global influence. Others counter that war accelerates fiscal exhaustion and erodes legitimacy, particularly when outcomes remain inconclusive. Empirical evidence from Iraq and Afghanistan demonstrates that military dominance does not translate into durable political control while imposing long-term economic burdens.

Game theory provides a useful framework for assessing likely end states without moral judgement. The interaction resembles a multi-player deterrence game with asymmetric escalation ladders and incomplete information. Iran’s optimal strategy under these conditions emphasises credible retaliation, alliance activation, and denial of decisive victory, thereby raising expected costs beyond acceptable thresholds for adversaries. The United States faces a dilemma in which backing down undermines credibility, while escalation risks uncontrollable regional war, alliance fragmentation, and economic shock. Israel’s position reflects acute vulnerability, incentivising pre-emption while simultaneously fearing retaliation beyond defensive capacity.

In such games, equilibrium often emerges through mutual restraint rather than decisive resolution. Each actor signals readiness while avoiding irreversible commitments, producing prolonged tension rather than open war. Miscalculation remains the primary risk factor, particularly under conditions of domestic political pressure or intelligence failure. However, as detection capabilities improve and regional cooperation against escalation strengthens, incentives increasingly favour delay, negotiation, or indirect confrontation rather than direct military engagement.

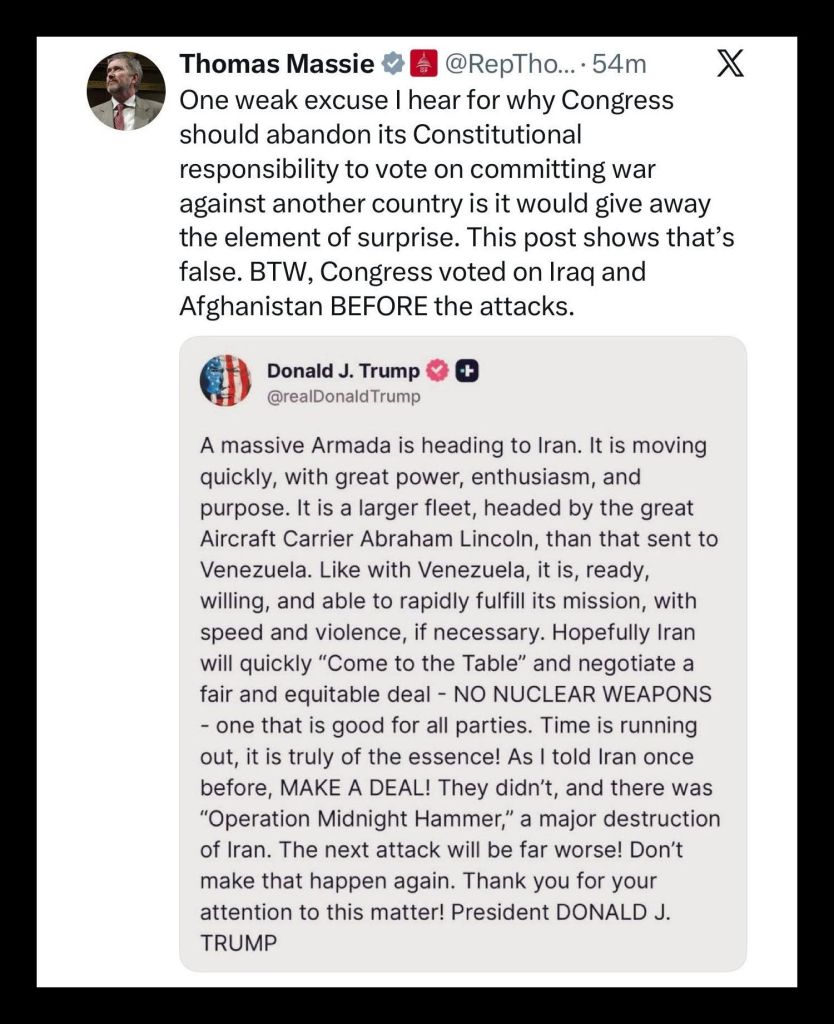

Under current conditions, the most likely outcome remains continued brinkmanship combined with proxy conflict, economic pressure, and sustained intelligence competition rather than immediate full-scale war. The risk of escalation nevertheless remains high, with consequences extending well beyond the region into global financial and energy markets. Market behaviour already reflects this stress, with gold trading around USD$5300 per ounce and silver near USD$114 per ounce, levels that signal severe uncertainty and fear of systemic disruption. Gold has long functioned as a widely observed barometer of chaos during periods of geopolitical instability, reflecting concern over currency credibility, energy supply security, and broader economic breakdown. A direct war involving Iran would likely trigger unprecedented disruption to oil supply and pricing, amplifying inflationary pressure across already strained global economies. President Trump’s role adds further instability, as he has openly acknowledged his unpredictability and his dependence on major political and financial backers whose interests influence decision-making. Despite this personal volatility, the broader trajectory is shaped less by individual leaders and more by structural constraints, including the limits of military force, the risk of regional retaliation, fragile alliance cohesion, and deep economic interdependence, all of which sharply increase the global cost of escalation.

Authored By: Global GeoPolitics

Thank you for visiting. This is a reader-supported publication. I cannot do this without your support. I am now restricted on Substack, basically censored. You can support by way of a cup of coffee:

buymeacoffee.com/ggtv or

Leave a comment