de-dollarisation

-

Collapse of Western Power and the Global System in 2026

Monetary Weaponisation, Financial Fragmentation and Strategic Overreach during the Western Collapse Phase Western power in 2026 reflects the accumulated outcome of choices made since the end of the Cold War.The system did not drift accidentally into its present condition. Policy decisions consistently favoured financial expansion, global leverage, and institutional growth over domestic production and social… Continue reading

AI and Digital Control, America, China, economics, Energy, EUROPE, Foreign Policy, Geopolitics, Global Finance, israel, NATO, politicsArctic geopolitics, China Strategy, de-dollarisation, Elite Overproduction, Empire Decline, energy geopolitics, Financialisation, Game Theory, Geopolitics, Greenland Resources, Iran Sanctions, Kinetic Conflict Risk, multipolarity, Naval Escalation, Oil Tanker Seizures, political economy, sanctions warfare, Shadow Fleets, US foreign policy, Venezuela Oil, World War 3 -

The United States as the Principal Adversary of its Own Currency

The political economy consequences of turning financial infrastructure into weapons hence de-risking from America is a rational response to concentrated monetary power The United States dollar emerged as the core instrument of global trade and finance after 1945, supported by American industrial dominance, military reach, and the Bretton Woods framework. That position rested on confidence… Continue reading

-

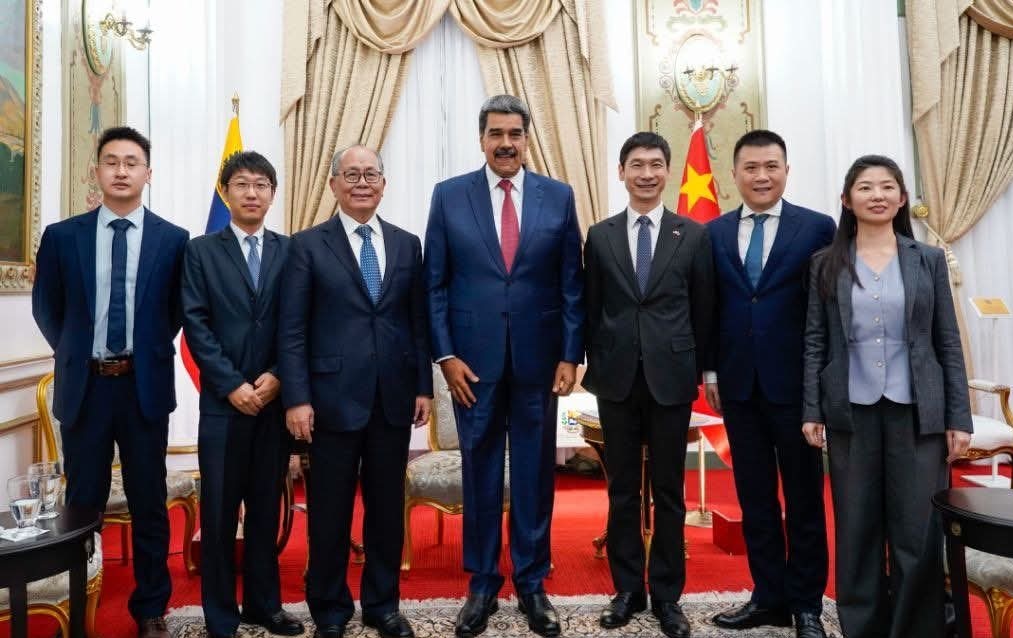

Maduro Removal In Defence of the Petrodollar System and Energy Dominance

How energy control sustains petrodollar power against multipolar challengers, China, Russia, BRICS expansion, and alternative payment systems The removal of Venezuela’s head of state formed part of a broader contest over the architecture of global payments, energy settlement, and monetary hierarchy. The operation did not arise from humanitarian urgency, democratic reform, or governance failure. Strategic… Continue reading